When studying for the CFE and PEP exams, writing cases is critical for success. Since you have limited amount of time to study, you may be wondering, should you write brand new cases or re-write prior ones to firm up your knowledge? Here are 3 reasons why writing new cases is better for your CPA studies.

#1: New cases teach new technicals

The CPA program has so many study resources, you won’t have time to go through all the readings. Writing new cases should be your primary source of learning technical material, because each case is filled with new technicals.

Between reading technicals or writing cases, writing cases is a better way to study for the CPA exams. While study notes and the eBook can be a good source for knowledge, writing cases helps you apply the topics in exam situations. The more cases you write, the more opportunity you have to understand how topics are tested on the exam. You also have a better opportunity of learning non-routine topics.

Rewriting cases you’ve previously written hinders your ability to test your understanding of the material, as you’ve already learned what is tested on the case and how to answer them.

#2: New cases help you practice your case approach

When writing new cases, you will experience situations when you can identify the AO correctly but you’ll be unsure how to answer it correctly. Most candidates’ fear in writing new cases is that they think they don’t know enough to even attempt the case. This shouldn’t be fear factor. If you’re in this situation, then take a guess on such AOs. You’ll be surprised on how often you get it right.

During the exam, you won’t have the opportunity to stop writing and search up the applicable technical. This means it’s critical to learn how to approach these AOs to the best of your ability, as leaving the AO blank is not an option. This is why writing new cases is a better way to study for the exam, it helps you practice your case writing skills.

Remember to attempt AOs through the general CPA response structure:

- Introduce the issue

- Assess using the Handbook, ITA, CAS, USO (users strategic objectives)

- Integrate case facts

- Explain the implication (i.e. answer the “so what” and “how / why” questions)

- Recommend

Writing new cases helps you to challenge yourself in developing your responses while replicating an exam setting, as you will already be familiar with the exam requireds on cases you have written previously. It also allows you to reflect on the major technical topics to determine if you feel comfortable addressing them.

#3: New cases teach time management

While rewriting cases can still provide some value in enhancing your time management skills, it takes away the unpredictability that happens during the exam. For example, you already know the number of AOs, where to find them, which ones require more time, etc. When writing new cases, you can truly focus on how to read the case efficiently, prioritize AOs based on your initial impressions, and decide quickly which ones you think will require more time.

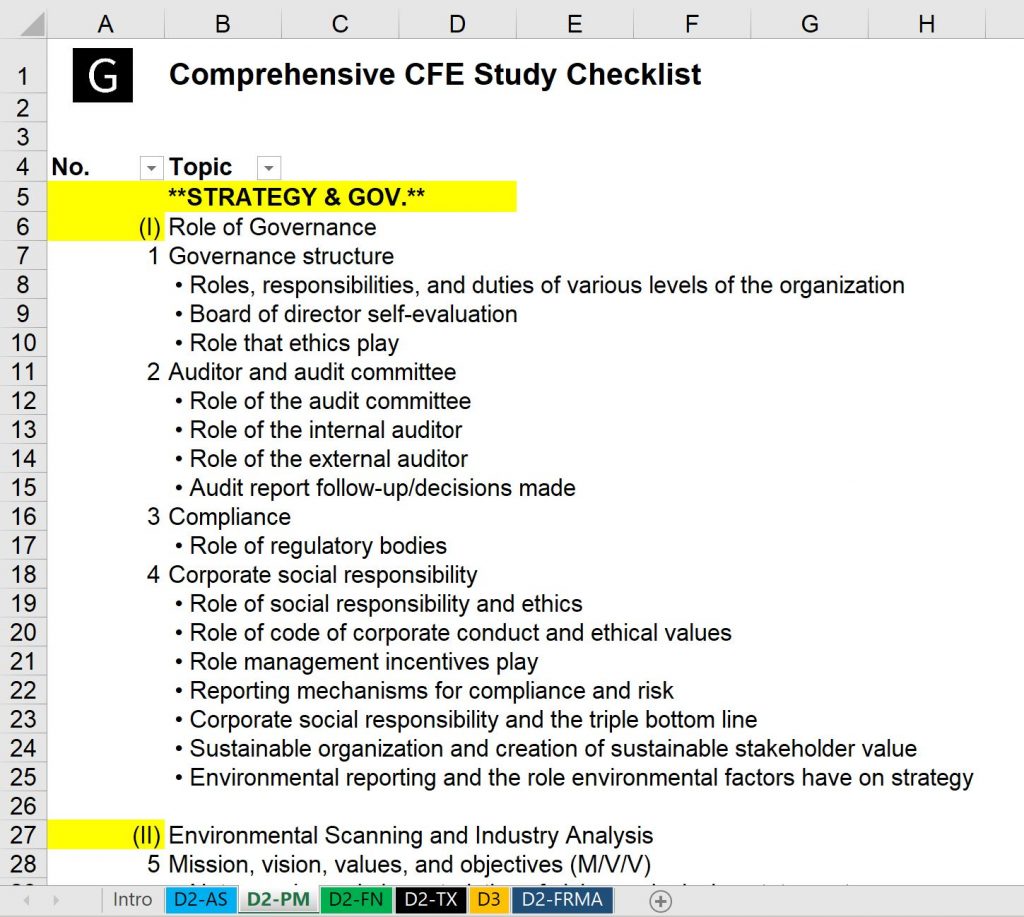

The more new cases you write, the more you will be able to learn how to allocate your time, and develop trust in sticking to your time budget. In getting exposure to more new cases, you will come across new topics in which you can create templates that will help you respond in a quicker manner if you come across that required again.

When to rewrite old cases

With all these benefits of writing brand new cases, it isn’t to say rewriting cases is not recommended. It’s about knowing when rewriting cases will add the most value to you.

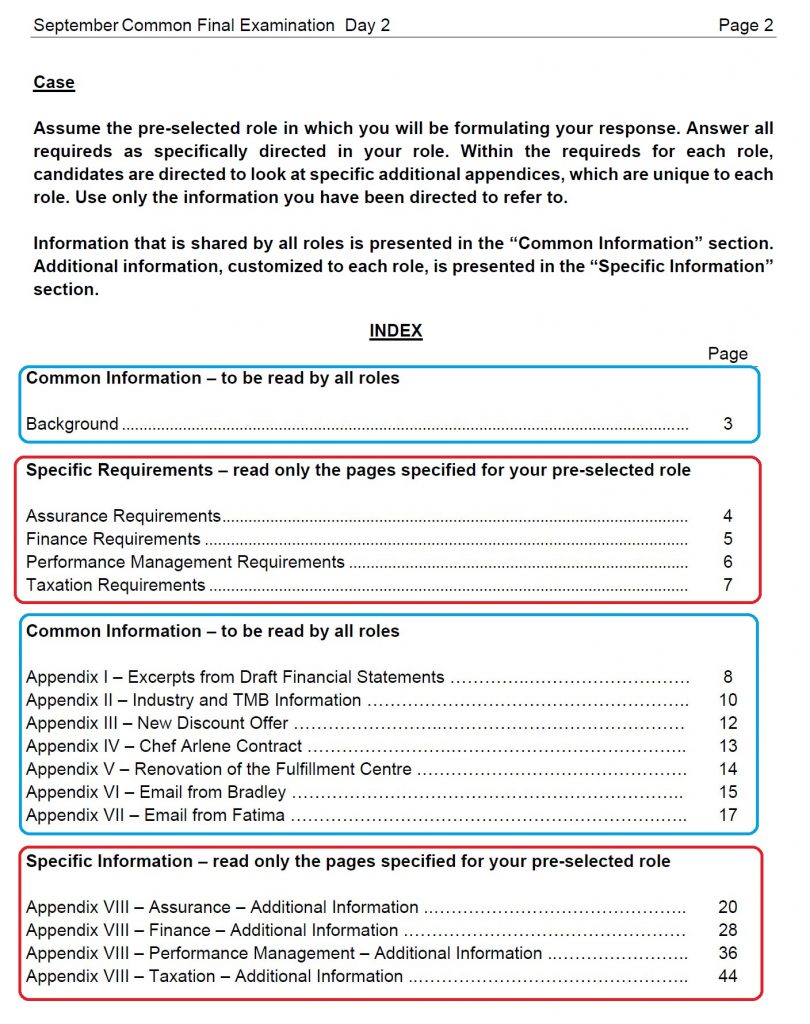

First, I recommend writing new cases, whether that be new supplemental cases or CPA module cases you’ve written before. After attempting these, you can then rewrite any that you found particularly challenging, or the AOs that you struggled with. For long CFE cases (ie, Day 2 cases), it’s a good idea to re-write only the AOs you struggled in, because you already have good understanding of other topics.

As you get closer to the exam date, rewriting cases holds more value. You can attempt to rewrite a case that you initially wrote at the beginning of your course, that wouldn’t be as fresh in your mind. This allows you to search to find AOs, apply technicals, apply case facts etc. making it feel almost like a new case. The difference now being that you improved your case writing skills since then. This is often a good motivator for candidates to see just how far they’ve come in their learning.

Conclusion

While writing new cases is important for practice, you want to balance this with what is reasonable for you to accomplish. There would be little value in writing a new case, but not having the sufficient time to debrief the cases you’ve already written. Proper debrief includes a review of the feedback guide, the solution, your responses, and summarizing the takeaways. For more tips on how to debrief a case, click here.